Territori’s 5-Year Plan

Planning ahead

Territori’s Future Plans: Building a Legacy in Namibia’s Tourism Sector

Territori is building the future of Namibia’s tourism real estate — with a clear 5-year plan titled “From Lodge to Legacy” .

We aim to acquire a new high-yield lodge every six months, offering investors long-term value backed by real assets.

With goals like cross-border expansion, investor liquidity, and institutional partnerships, our roadmap ensures steady growth, transparency, and returns you can trust.

Ever wanted to invest in Namibia but you couldn’t find that excitement factor in the options?

Territori does not only provide a ROI of 8% – 10%, but we also offer flexibility in how you chose to receive your returns. You can opt for the standard monetary value of your shares, or you can choose to use the physical room nights (30 nights per share). These room nights you can either use yourself to stay at the properties of Territori, or

you can sell these exclusive bed nights to a friend or family member at a price of your choosing.

Introduction to Territori

Territori is a real estate investment company focused on Namibia’s thriving tourism sector, specifically targeting highyield tourism properties. Our initial portfolio includes a

successful lodge—Lapa Lange. The goal is to leverage Namibia’s burgeoning investment climate, driven by recent oil discoveries and increasing tourist activity, to provide lucrative

opportunities for investors.

Success

VISION STATEMENT

To become Namibia’s most trusted and dynamic private investment portfolio — built not on theory, but on land, lodges, and performance.

MISSION STATEMENT

Our mission is straightforward: acquire one new, income-producing lodge every six months. Every property is locally operated,

professionally managed, and independently audited. We’re targeting no

less than 10% annual portfolio growth — with real returns,not just projections.

Committed

Investment Opportunity Overview

Shares Immediately Available: 50 Class B shares available at an investment of [currency amount=”1000000″ from=”NAD” to=”EUR”] per share.

Return on Investment (ROI): Investors will earn based on the average occupancy rate of Lapa Lange and future properties, with a current national average of *63.02%* provided as an indication only. Returns are calculated

semi-annually and paid out twice a year.

Investor Benefits: Investors have the choice between receiving financial returns or enjoying *30 days of free accommodation* per year (bed and breakfast) at Lapa Lange and future properties per share they own. One investor can own multiple shares and choose to have, for example, 2 shares paid out as accommodation benefits and other shares as ROI. This benefit offers a direct experience of the luxury that Territori provides.

Average Room Rate: The average price per night per room is [currency amount=”5000″ from=”NAD” to=”USD”], contributing to the return calculations.

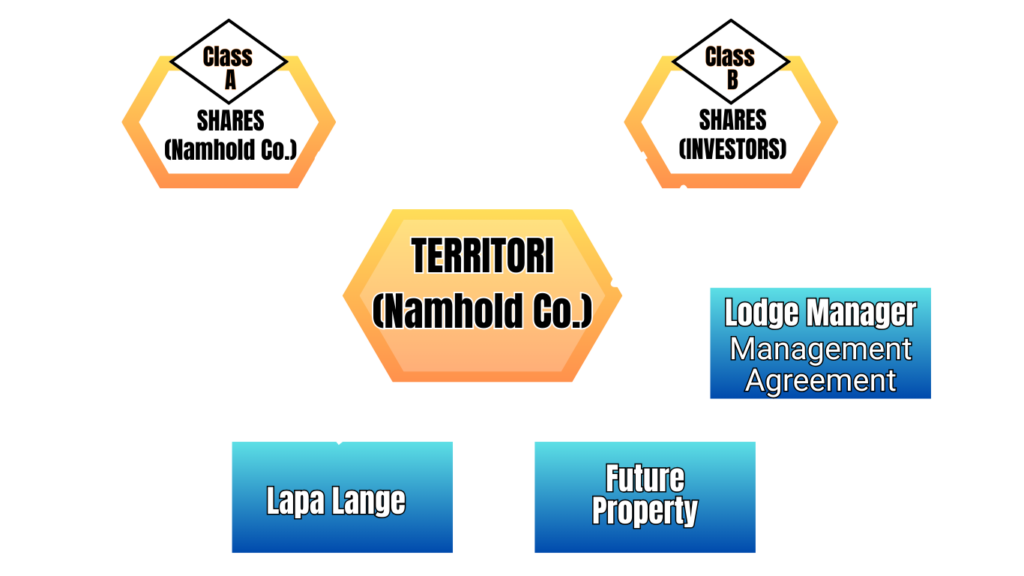

Structure Overview

Operational Structure

• The investment and operations structure of Territori is designed for transparency, profitability, and effective management:

• Namhold Co: This is the holding company for the properties and operations, managed under a strict agreement.

• Hotel Management Agreement: The hotel operations are managed by a professional hotel manager appointed by the Namhold Co. The

manager handles day-to-day operations, ensuring the lodges are run efficiently, maximizing returns for investors.

• Agency Agreement: Namhold Co is also engaged under an agency agreement with Lapa Lange, ensuring strategic procurement of

bookings and smooth management of the property.

Investment Model & Revenue Generation

The revenue generated comes from the rental income of the properties, distributed as follows:

- Investors gain returns calculated semi-annually based on the occupancy rates.

- Investors gain returns calculated semi-annually based on the occupancy rates.

- The occupancy rates and income per bed night determine the payout, which is made twice a year.

- Investors have the unique option to choose between financial returns or enjoying 30 nights of accommodation at the lodges.

How the structure fits together

Namhold Co is the holding entity that issues shares and holds the rights to the properties.

MAU HoldCo holds A Shares, while *Investors* hold B Shares, granting them a secured interest in the property value and rights to occupancy.

Hotel Management Agreements ensure professional operation of properties, contributing to stable returns.

Lodge Managers work to keep occupancy high, which drives ROI.

Structure Layout for Better Understanding

Please refer to the flow diagram for a visual representation of the structure, including the relationships between Namhold Co. (TERRITORI), MAU HoldCo, Class B Investors, Hotel Manager, and properties like Lapa Lange. This diagram provides a clear illustration of the compulsory offtake agreements, management agreements, and

the overall organizational structure, ensuring transparency and better understanding of

the operational model.

Exit Strategy

Investors can opt to:

• Sell their shares back to Territori at the *share certificate value* (Territori will have the *first right of refusal*), or

• Trade their shares on the *open market*, providing liquidity and flexibility.

BEFORE WE CONTINUE

LET'S HAVE A LOOK AT OUR ONE OF A KIND

SPECIAL OFFER !

The Golden 50

Play video

For the early believers who see the opportunity now — the first 50 Class B shares we ever issue come with a permanent edge: 35 room nights per share, every year, for life.

That alone gives you a 17.5% return in lifestyle value, before a single dividend is paid. Once those 50 shares are spoken for, all future shares drop

back to the standard 30 nights per year.

We won’t repeat the offer — and we won’t dilute it.

The 5 Year Plan

Theme: From Lodge to Legacy

• Target: Smart, future focused investors — including high-net-worth

individuals, private clients, expats, institutional players, and funds in

Namibia, South Africa, Europe, Russia, and the USA

• YEAR 1: Foundation & Lock-In

• YEAR 2: Expand Visibility & Investor Base

• YEAR 3: Open Liquidity & Cross Borders

• YEAR 4: Institutional Capital & Structure

• YEAR 5: Ownership Liquidity & Investor Exit Options

Year 1

Foundation & Lock-In

Goal: Cement trust and place all 50 Golden Shares

Build a solid footprint in the territory of investment.

Announce Golden 50 offer and structure

Run direct outreach via WhatsApp and private investor circles.

Share Lapa Lange occupancy stats and audited performance.

Hold briefings in Windhoek, Cape Town, and Lisbon.

Register with African investment platforms.

Activate commission based referral program.

Secure respected backers (attorneys, former regulators).

Year 2

Expand Visibility & Investor Base

Goal: Raise US$ 8,325,000.00 under the standard 30-night share model

Investor portal live: share tracking, reports, statements.

Promote the frozen Golden

Tier as a “closed club”

Media: “Territori Golden 50 closed

— what now?”

Begin international

targeting:

Showcase lodge upgrades and

real asset growth

🇩🇪 German speaking

communities

Launch Stay + Invest lodge

weekend events

🇿🇦South African

trusts and advisors

🇪🇺 Residency focused

investors across the EU

Year 3

Open Liquidity & Cross Borders

Goal: Launch resale channel and bring in foreign capital.

1

Deploy “Stay &

Invest” campaign

(video, social)

2

Finalize legal gateway via

Portugal or

Germany

3

Publish 8–12% ROI

performance

confirmation

4

Activate

peer-to peer

resale path for

Class B shares

5

Add two more

lodges in Namibia’s

Golden Circle

6

Release “3-Year

Impact Report” —

audited and visual

Year 4

Institutional Capital & Structure

Goal: Attract multi-investor entities and foreign funds

Strategic Engagement

Host Territori Capital Roundtable in Lisbon and Frankfurt

Empowering Investors

Launch the investor passport model (multi-lodge credit use)

Building a Scalable Framework

Set up SPV "Wrapper" to onboard EU/UK/US investors cleanly

Strengthening Key Functions

Expand investor support team (legal, admin, IR)

Honoring Legacy and Friendship

Celebrate Golden 50 reunion weekend at Lapa Lange.

Year 5

Ownership Liquidity & Investor Exit Options

Goal: Cross US$ 27,750,000.00 AUM, operate 10+ lodges, and explore exit pathways.

Publish comprehensive 5-Year Performance Report.

Golden 50 perks reaffirmed as permanent and closed.

Offer PE-linked partial exits or keep rolling forward.

Roll out investor coownership model.

Transition Territori to semi-public investor platform, but keep the core local and real.

ARE YOU READY

TO INVEST

Are you ready to be part of the founding investors club of Territori?

Hard Asset Security “You’re not buying potential. You’re investing in property.

Lifestyle ROI “35 nights per year — worth more than some portfolios.

Freedom to Choose . Each share, each term — you decide how to earn.

Scarcity = Legacy . Only 50 shares will ever carry the Golden status. One investor could take them all.

Proof, Not Promises . Audited. Operating. Booked. Verified.

Namibia’s Rise. Tourism, oil, infrastructure — Namibia’s moment is now. Territori is how you own it.