Investment Information

and Future Planning

Territori’s Future Plans: Building a Legacy in Namibia’s Tourism Sector

Territori is building the future of Namibia’s tourism real estate — with a clear 5-year plan titled “From Lodge to Legacy” .

We aim to acquire a new high-yield lodge every six months, offering investors long-term value backed by real assets.

With goals like cross-border expansion, investor liquidity, and institutional partnerships, our roadmap ensures steady growth, transparency, and returns you can trust.

VISION STATEMENT

To become Namibia’s most trusted and dynamic private investment portfolio — built not on theory, but on land, lodges, and performance.

MISSION STATEMENT

Our mission is straightforward: acquire one new, income-producing lodge every six months. Every property is locally operated,

professionally managed, and independently audited. We’re targeting no

less than 10% annual portfolio growth — with real returns, not just projections.

Committed

Investment Opportunity Overview

Shares Immediately Available: 50 Class B shares available at an investment ofUS$ 61,000.00 per share.

Return on Investment (ROI): Investors will earn based on the average occupancy rate of Lapa Lange and future properties, with a current national average of *63.02%* provided as an indication only. Returns are calculated

semi-annually and paid out twice a year.

Investor Benefits: Investors have the choice between receiving financial returns or enjoying *30 days of free accommodation* per year (bed and breakfast) at Lapa Lange and future properties per share they own. One investor can own multiple shares and choose to have, for example, 2 shares paid out as accommodation benefits and other shares as ROI. This benefit offers a direct experience of the luxury that Territori provides.

Average Room Rate: The average price per night per room is US$ 305.00, contributing to the return calculations.

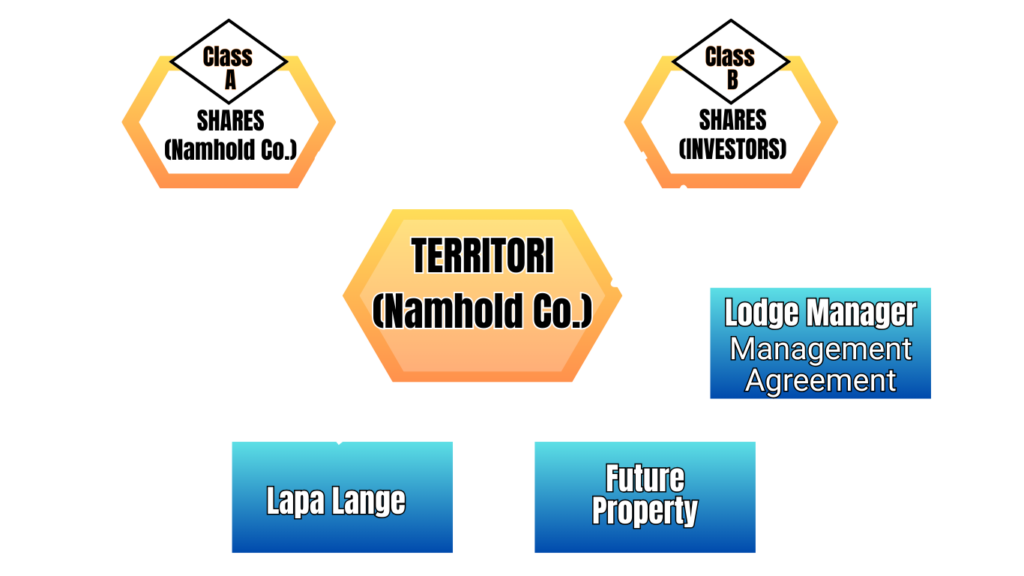

Structure Overview

Operational Structure

• The investment and operations structure of Territori is designed for transparency, profitability, and effective management:

• Namhold Co: This is the holding company for the properties and operations, managed under a strict agreement.

• Hotel Management Agreement: The hotel operations are managed by a professional hotel manager appointed by the Namhold Co. The

manager handles day-to-day operations, ensuring the lodges are run efficiently, maximizing returns for investors.

• Agency Agreement: Namhold Co is also engaged under an agency agreement with Lapa Lange, ensuring strategic procurement of

bookings and smooth management of the property.

Investment Model & Revenue Generation

The revenue generated comes from the rental income of the properties, distributed as follows:

- Investors gain returns calculated semi-annually based on the occupancy rates.

- Investors gain returns calculated semi-annually based on the occupancy rates.

- The occupancy rates and income per bed night determine the payout, which is made twice a year.

- Investors have the unique option to choose between financial returns or enjoying 30 nights of accommodation at the lodges.

How the structure fits together

Namhold Co is the holding entity that issues shares and holds the rights to the properties.

MAU HoldCo holds A Shares, while *Investors* hold B Shares, granting them a secured interest in the property value and rights to occupancy.

Hotel Management Agreements ensure professional operation of properties, contributing to stable returns.

Lodge Managers work to keep occupancy high, which drives ROI.

Structure Layout for Better Understanding

Please refer to the flow diagram for a visual representation of the structure, including the relationships between Namhold Co. (TERRITORI), MAU HoldCo, Class B Investors, Hotel Manager, and properties like Lapa Lange. This diagram provides a clear illustration of the compulsory offtake agreements, management agreements, and

the overall organizational structure, ensuring transparency and better understanding of

the operational model.

Exit Strategy

Investors can opt to:

• Sell their shares back to Territori at the *share certificate value* (Territori will have the *first right of refusal*), or

• Trade their shares on the *open market*, providing liquidity and flexibility.

Unique Return Opportunities

Tailored Wealth Paths with Territori Investments

Step into the welcoming embrace of Territori Investments, where Namibia’s thriving tourism boom unfolds into two heartfelt paths: one for those dreaming of abundant profits, and another for those yearning for a luxurious retreat—both yours to claim with just N$1 million per share!

For Lifestyle Lovers

Why settle for a typical investment when you can score 30 free nights a year at the stunning Lapa Lange lodge—or future gems in Namibia’s tourism crown—for every N$1 million share you own? Picture yourself unwinding in luxury, amidst Namibia’s breathtaking landscapes, all while your investment stays secure in a growing portfolio. With the option to mix cash and stays if you grab multiple shares, plus the promise of new properties in vibrant Lüderitz, Windhoek, and Walvis Bay, this isn’t just a deal—it’s a lifestyle upgrade. Managed by professionals with a buyback safety net, your slice of paradise is waiting—join early for the best perks!

For Profit Seekers

Imagine pocketing a steady stream of profits from a lodge with a solid 63.02% national occupancy rate—numbers that ride the wave of Namibia’s surging tourism, fueled by oil discoveries and growing visitor numbers. You’re not just buying a stake in Lapa Lange—you’re tapping into a professionally managed cash cow with plans to expand into hotspots like Lüderitz and Windhoek. With transparent profit splits paid twice a year, the flexibility to sell your share, and a safety net if the property is sold, this is your chance to turn Namibia’s growth into your financial win. Early investors get priority—jump in now and watch your returns soar!

BEFORE WE CONTINUE

LET'S HAVE A LOOK AT OUR ONE OF A KIND

SPECIAL OFFER !

The Golden 50

Play video

For the early believers who see the opportunity now — the first 50 Class B shares we ever issue come with a permanent edge: 35 room nights per share, every year, for life.

That alone gives you a 17.5% return in lifestyle value, before a single dividend is paid. Once those 50 shares are spoken for, all future shares drop

back to the standard 30 nights per year.

We won’t repeat the offer — and we won’t dilute it.

Concise Overview

Your investment journey with Territory Investment Portfolio.

IN A NUTSHELL:

Territori Investments is your chance to join a warm, exclusive circle—owning a piece of a luxurious lodge for US$ 61,000.00 per share.

Whether you’re here to cash in on tourist stays or savor free vacations in Namibia’s breathtaking landscapes, this is where profit meets passion.

With plans to grow and a team you can trust, we’re riding the wave of Namibia’s tourism boom—together.

Ready to step in?

Step In with Class B Shares

Your Ticket to Ownership

With 80 exclusive shares up for grabs at US$ 61,000.00 per share , you’re not just buying a share you’re stepping into part ownership of a stunning lodge business. It’s like securing your spot in a cozy, lucrative club where the rewards are as real as the Namibian sunsets..

How the Money Flows

A Lodge That Pays You Back

Picture this: our flagship lodge, Lapa Lange, welcomes tourists at US$ 305.00 per room per night. With a national occupancy rate averaging a solid 63.02%, those rooms are buzzing with guests more than half the time!

Twice a year summarize each properties performance and share the profits between investors who chose to cash in and for those who chose a luxurious adventure instead will receive a report on where and when they have spent their days.

It’s a steady stream of returns, fueled by Namibia’s tourism surge.

Choose Your Reward

Cash or a Cozy

Getaway—You Decide!

Here’s where it gets exciting: you pick how to enjoy your investment: Cash Returns: Pocket real money based on the lodge’s success—perfect for the profit-minded. Free Stays: Claim 30 complimentary nights per year per share at Lapa Lange, complete with bed and breakfast. Own two shares? That’s 60 nights of pure bliss! Mix It Up: Got multiple shares? Blend cash and stays however suits your heart. It’s your investment, your way— tailored to fit your dreams.

Who’s Behind the Scenes?

A Team You Can Trust

Rest easy knowing your investment is in good hands: Territori: Our parent company owns the properties and oversees the big picture with care. Hotel Manager: A seasoned professionals keeps the lodge humming—booking guests and keeping everything spotless. Agency Agreement: A smooth system ensures operations run like clockwork. We’re all about making this a hassle-free, heartwarming venture with you.

Dreaming Bigger

More Lodges, More Opportunities

This is just the beginning! Territori has its sights set on expanding to vibrant hotspots like Lüderitz, Windhoek, and Walvis Bay—places where tourism and business are blossoming. Your investment today could grow into a network of thriving properties tomorrow.

The 5 Year Plan

Theme: From Lodge to Legacy

• Target: Smart, future focused investors — including high-net-worth

individuals, private clients, expats, institutional players, and funds in

Namibia, South Africa, Europe, Russia, and the USA

• YEAR 1: Foundation & Lock-In

• YEAR 2: Expand Visibility & Investor Base

• YEAR 3: Open Liquidity & Cross Borders

• YEAR 4: Institutional Capital & Structure

• YEAR 5: Ownership Liquidity & Investor Exit Options

Year 1

Foundation & Lock-In

Goal: Cement trust and place all 50 Golden Shares

Build a solid footprint in the territory of investment.

Announce Golden 50 offer and structure

Run direct outreach via WhatsApp and private investor circles.

Share Lapa Lange occupancy stats and audited performance.

Hold briefings in Windhoek, Cape Town, and Lisbon.

Register with African investment platforms.

Activate commission based referral program.

Secure respected backers (attorneys, former regulators).

Year 2

Expand Visibility & Investor Base

Goal: Raise US$ 9,150,000.00 under the standard 30-night share model

Investor portal live: share tracking, reports, statements.

Promote the frozen Golden

Tier as a “closed club”

Media: “Territori Golden 50 closed

— what now?”

Begin international

targeting:

Showcase lodge upgrades and

real asset growth

🇩🇪 German speaking

communities

Launch Stay + Invest lodge

weekend events

🇿🇦South African

trusts and advisors

🇪🇺 Residency focused

investors across the EU

Year 3

Open Liquidity & Cross Borders

Goal: Launch resale channel and bring in foreign capital.

1

Deploy “Stay &

Invest” campaign

(video, social)

2

Finalize legal gateway via

Portugal or

Germany

3

Publish 8–12% ROI

performance

confirmation

4

Activate

peer-to peer

resale path for

Class B shares

5

Add two more

lodges in Namibia’s

Golden Circle

6

Release “3-Year

Impact Report” —

audited and visual

Year 4

Institutional Capital & Structure

Goal: Attract multi-investor entities and foreign funds

Strategic Engagement

Host Territori Capital Roundtable in Lisbon and Frankfurt

Empowering Investors

Launch the investor passport model (multi-lodge credit use)

Scalable Framework

Set up SPV "Wrapper" to onboard EU/UK/US investors cleanly

Strengthening Key Functions

Expand investor support team (legal, admin, IR)

Honoring Legacy and Friendship

Celebrate Golden 50 reunion weekend at Lapa Lange.

Year 5

Ownership Liquidity & Investor Exit Options

Goal: Cross US$ 30,500,000.00 AUM, operate 10+ lodges, and explore exit pathways.

Publish comprehensive 5-Year Performance Report.

Golden 50 perks reaffirmed as permanent and closed.

Offer PE-linked partial exits or keep rolling forward.

Roll out investor coownership model.

Transition Territori to semi-public investor platform, but keep the core local and real.

ARE YOU READY

TO INVEST

Are you ready to be part of the founding investors club of Territori?

Hard Asset Security “You’re not buying potential. You’re investing in property.

Lifestyle ROI “35 nights per year — worth more than some portfolios.

Freedom to Choose . Each share, each term — you decide how to earn.

Scarcity = Legacy . Only 50 shares will ever carry the Golden status. One investor could take them all.

Proof, Not Promises . Audited. Operating. Booked. Verified.

Namibia’s Rise. Tourism, oil, infrastructure — Namibia’s moment is now. Territori is how you own it.

DO YOU HAVE ANY QUESTIONS? CONTACT US AT BELOW INFORMATION.

Frequently Asked Questions.

Your investment is safeguarded by a buyback safety net—if the lodge is sold, you receive a proportional share of the proceeds, reducing the risk of total loss and offering a layer of financial reassurance.

While profits are tied to occupancy, Territori professional management and Namibia’s tourism growth trajectory aim to mitigate downturns. Lower occupancy would reduce cash returns, but your free stay option remains intact.

Absolutely—Territori encourages potential investors to experience Lapa Lange firsthand. Contact us to arrange a visit and witness the luxury and potential for yourself.

- US$ 305.00 × 0.667 × 30 = US$ 6,103.05 annual gross per share

- If you own a share, you earn US$ 6,103.05 annually.

You have flexibility—sell your share back to Territori under agreed terms or find a private buyer. The growing tourism market could enhance your share’s appeal over time.

No hidden surprises here—the N$1 million covers your entry.

Territori’s expansion targets high-growth areas fueled by tourism and business demand. Territori expertise and market research guide these choices, though, as with any investment, success isn’t guaranteed—only strategically pursued.

Flexibility is key—you can adjust your preference annually before profit calculations, provided you notify us in advance. Multiple-share owners can even split options across their holdings.

You’ll receive regular updates—financial reports, occupancy stats, and management insights—delivered with clarity and consistency, so you’re always in the loop on how your investment is performing.

Investors from all over the world are welcome. We are happy to assist with currency conversion or any other compliance related questions.

1. Go to the lodge’s website and select the “book now” option.

2. You’ll then be able to see available dates to book your stay.

3. When booking your stay, use your unique investors’ ID number as reference.

4. The facility providing the accommodation will then contact Territori for confirmation that you still have available investors nights left. (Should you only have 2 nights left and would like to stay 3 nights, the facility will only bill you for 1 night)

5. After confirming your available investors’ nights with Territori, you will receive an email from the accommodation facility confirming your stay.